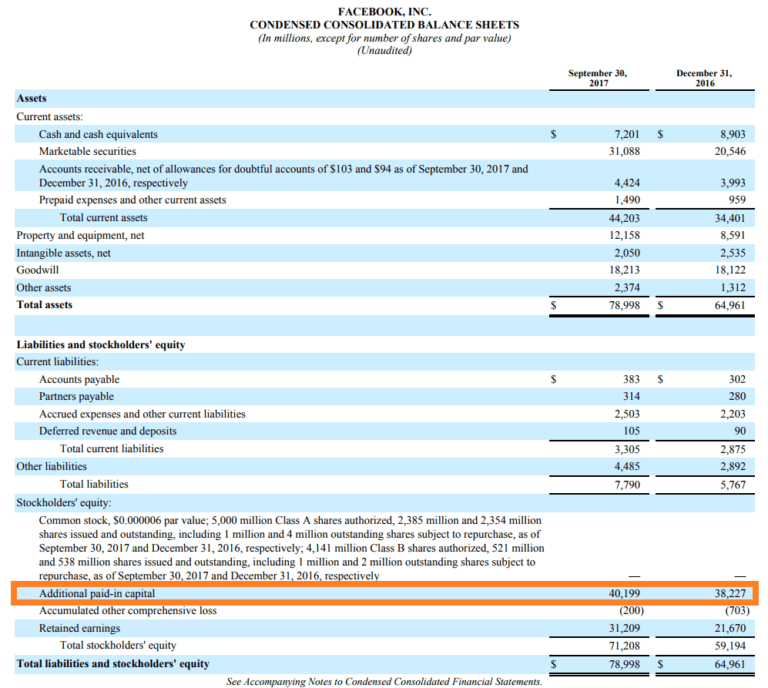

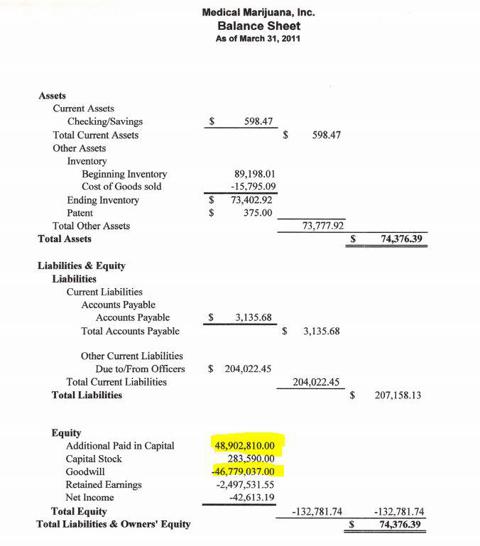

Additional paid-in capital is shown in the Shareholders' Equity section of the balance sheet. For example, if 1,000 shares of $10 par value common stock are issued by a corporation at a price of $12 per share, the additional paid-in capital is $2,000 (1,000 shares × $2).Excess received from shareholders over the par value (or stated value) of the stock issued also called contributed capital in excess of par.B = Additional paid-in capital (a.k.a.

#ADDITIONAL PAID IN CAPITAL PLUS#

It includes share capital (capital stock) as well as additional paid-in capital. You need to log in first to add your comment.Paid-in capital (also paid-up capital and contributed capital) is capital that is contributed to a corporation by investors by purchase of stock from the corporation, the primary market, not by purchase of stock in the open market from other stockholders (the secondary market). If the 1 million shares of stock were sold to the public in one batch at a market value of $45 dollars, it would appear as such Par value for stock is usually $1.00, regardless of stock price, this helps show the amount of shares outstanding. (c) the difference is included within share premium or additional paid-in capital or a similar component of equity. Whether Paid in Capital will also contribute to Equity?Īnd does par value denote the face value of the stock? If 100 shares are issued, then, APIC (50 5) x 100. The remaining $500 ($1,500 - $1,000) will be recorded as Additional Paid-in Capital.Įquity means: Contributed Capital + Retained Earnings - Treasury Stock (buyback shares) + comprehensive income.Ĭomprehensive Income includes effect of foreign exchange rate changes. Therefore, Additional Paid-in Capital Formula (Issue Price Par Value) x number of shares issued. Rethan, if $1,500 were paid for 1,000 stocks with par value of $1.00 per stock, then $1,000 ($1.00 x 1,000) will be recorded as Contributed Capital. What does "with the remaining amount invested contained in additional paid in capital" mean? The shareholders' equity section of the balance sheet lists the items in contributed capital and retained earnings on the balance sheet date.For example, it includes capital transactions with owners (e.g., issuing shares) and distributions to owners (i.e., dividends).

The statement of shareholders' equity is a financial statement that summarizes changes that occurred during the accounting period in components of the stockholders' equity section of the balance sheet.It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. This statement reflects information about increases or decreases to a company's net assets or wealth. Statement of Changes in Shareholders' Equity This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. The price of new shares sold to the public. It decreases stockholder's equity and total shares outstanding. Paid-in capital arising from the sale of treasury stock should not be included in the measurement of net income. Already been fully issued and was outstanding.These are the total earnings of the company since its inception less all dividends paid out.

Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital.

This includes preferred stocks and common stocks. The amount of money which has been invested in the business by the owners. There are five potential components that comprise the owner's equity section of the balance sheet: Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities).

0 kommentar(er)

0 kommentar(er)